Think of your small business as a tiny boat making its way across the ocean with you as its captain. Many dangers and pitfalls will arise as you steer your craft through the waves. Learn about the most common threats, and take steps to prevent them.

(infographic below article)

PROPERTY DAMAGE

You cannot serve your customers or make a profit if your workplace is damaged due to fire or natural disaster. By their very nature, many of these incidents are totally beyond your ability to prevent or control. That is why it is vital to obtain a comprehensive commercial insurance policy that will cover the often high costs of property damage so that you can get your establishment up and running again as quickly as possible.

BUSINESS INTERRUPTION

During the time that your business is out of commission due to fire, equipment breakdown, catastrophic theft or some other cause, you are unable to remain open, pay your employees or serve your customers. If 50 percent of businesses in any given year experience an unforeseen interruption, that amounts to a great deal of time and money lost – not to mention damage to your brand and reputation. Fortunately, there is coverage known as business interruption insurance that can help. It will compensate you for the profits you can reasonably be expected to have earned while your doors were closed, pay for general operating expenses and even the cost of temporarily relocating to another property in order to keep your business open.

THEFT

Stealing can come in many forms, from the occasional pilfering of office supplies by an employee all the way to burglary that results in the loss of your expensive equipment. If you think that the average shoplifting incident leads to a loss of $129 for you, the business owner, just imagine how the tab will grow over time. Although you can never be entirely theft-proof, you should take steps to ensure that your property is secure. Install a burglar alarm system. If appropriate, also include motion sensors and cameras. Train your staff how to spot suspicious behaviors, and don’t be afraid to turn thieves in to the authorities.

THE INTERNET

If $1 trillion in intellectual property was stolen by hackers way back in 2008, imagine how much higher that number must be today. If your business has an online presence, you have probably discovered how powerful this medium can be when it comes to attracting new customers and getting the word out about your company. At the same time, cyberspace often has the feel of the Old West, where many rules are lax or nonexistent and the criminal element runs wild. The data you store about your enterprise as well as your customers needs to be kept safe from the malicious intrusion of thieves, some of whom are thousands of miles away and untouchable by U.S. law. Maintaining firewalls and keeping your antivirus and other software updated can prevent you from being an easy mark for the unscrupulous. If you are not an expert on cyber-security, strongly consider consulting with a company specializing in this area. Finally, consider purchasing cyber liability coverage to protect you in the event of a breach.

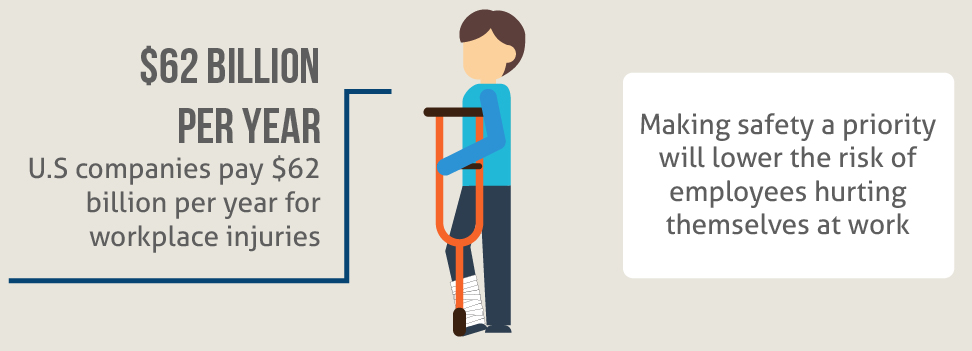

WORKPLACE INJURIES

Maintaining standards at your place of business that promote the safety of employees and customers alike should be one of your highest priorities. Accidents at work are extremely costly on so many levels: They lead to periods of time when your short-handed, can cost you thousands and even hundreds of thousands of dollars in medical bills and, in the worst case, can ultimately lead to protracted, expensive and emotionally draining lawsuits. You simply cannot afford to go without worker’s compensation insurance, which helps injured employees with medical costs and lost wages while simultaneously protecting you from being sued. In addition, your liability coverage is a vital safety net that can protect you if a customer or other third party is injured at your site.

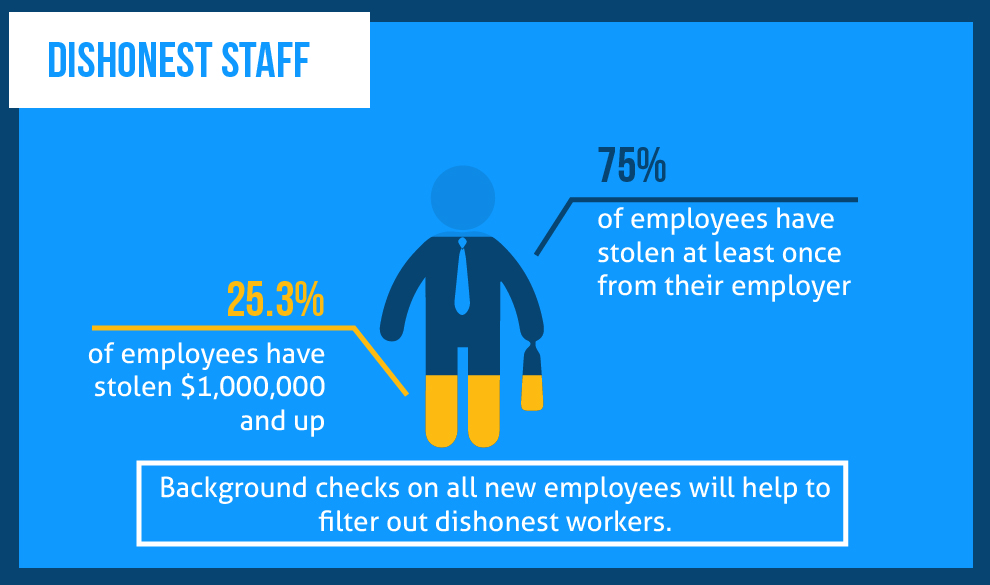

DISHONEST EMPLOYEES

The average organization loses an average of 5 percent of its annual revenue to occupational fraud and worker theft. Whether small or large, no business can afford this level of loss. While you should not automatically assume that every employee is a fraud or a thief, it behooves you to maintain a watchful attitude. Start by doing background checks on all new employees. Continue by fostering an atmosphere of teamwork and open communication among all of your workers that will encourage employees to come to you if they see something suspicious. Finally, listen to your gut. If something doesn’t feel or look right, investigate it tactfully, carefully and thoroughly. If your worst fears are confirmed, address the issue immediately, consulting the police if appropriate.

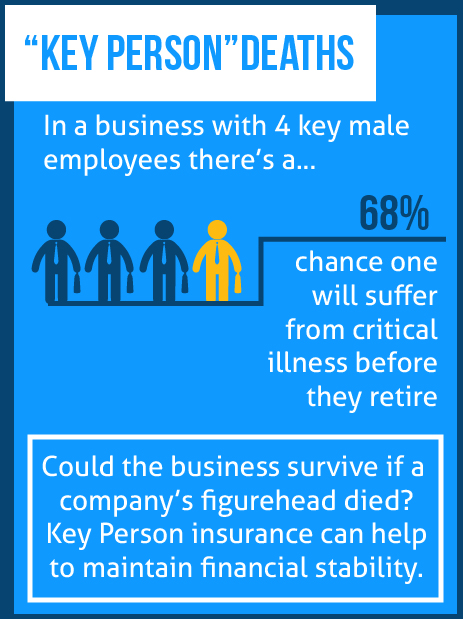

THE DEATH OF A KEY EMPLOYEE

THE DEATH OF A KEY EMPLOYEE

If you run your company in partnership with a few others, ask yourself what would happen if one of these integral people were to die suddenly or become permanently disabled and unable to work. Many businesses would be dealt a severe blow if this were to happen. Key Person Insurance is designed to give your business a financial lifeline after the loss of a pivotal member of your staff that is there until you have regained your equilibrium.

MALWARE

A little less than one-third of us have experienced that sinking feeling that comes when all of our files and data fall prey to a virus or other type of malware attack. This same jolting scenario can also happen within your business’s computer systems, resulting in chaos, distress, loss of income and countless hours of time spent trying to recover. Don’t wait until this happens to you. Protect yourself today by ensuring that all of your operating systems and software are upgraded to the most recent update. Take steps to ensure that you are protected against viruses and other malware, enlisting the help of an IT consultant if you don’t have the time or expertise yourself. This is an investment that could pay for itself several times over in the event of a cyber-attack.

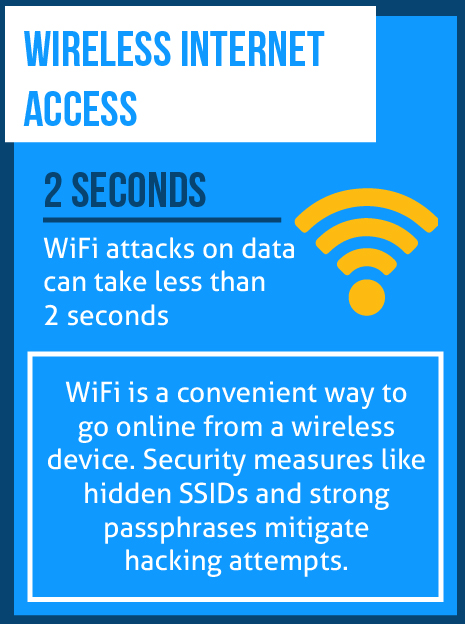

WIRELESS INTERNET ACCESS

Protect your data from the ninja-style onslaughts that can be perpetrated wirelessly in a matter of seconds. To turn away novice hackers, you can hide your service set identifier, in effect cloaking your network name from being publicly broadcast. However, any hacker worth her salt can circumnavigate this strategy. Talk to your IT professional instead about using Wi-Fi Protected Access (WPA) or WPA2.

TERRORIST ATTACKS

Especially since the events of 2001, companies have become concerned about the toll that terrorist attacks can take. If you have a company that focuses on imports and exports or is responsible for carrying goods and freight, you are particularly vulnerable. Making sure to take advantage of cutting-edge security precautions as well as ongoing communication with local law enforcement authorities can minimize your level of risk.

DATA LOSS

Many business owners take the time to back up their data, a practice that could not be any more essential. However, that is only one piece of the puzzle. You also need to be sure that the hardware designed to safeguard your precious data is not itself faulty. Take the time to do annual or semi-annual system checks, obtaining assistance from the experts. Your data is far too important to lose.

CORPORATE ESPIONAGE

CORPORATE ESPIONAGE

It isn’t just something from a B movie; corporate espionage is very real. If your company has intellectual property or a brand to protect, be very careful to entrust private information to only a very few solid employees. You can also invest in insurance to protect your patents and copyrights against piracy or theft.

ENVIRONMENTAL DAMAGE

If your company has an impact on the environment around you because of chemicals it spews into the air or water, it is incumbent upon you to take steps to minimize the damage you cause. Protect yourself from nasty lawsuits and a catastrophic blow to your reputation by performing a risk analysis and potentially changing the way you do business if that is what it takes.

NO HUMAN RESOURCE POLICIES

As a business owner, setting forth straightforward, fair and accessible employee policies is your responsibility. Doing so not only lets your workers know exactly what you expect, but also it protects you in the event of a dispute after terminating someone’s position. Having written manuals and policies in place can save you from distressing and costly lawsuits that have the potential to drain your resources.

POOR MANAGEMENT

Challenging, nurturing and protecting your employees is the task of a good manager. Be sure your supervisory staff understands the importance of maintaining both a high standard of work and fostering employees who are treated well and understand their jobs. To keep the cream of the crop from leaving, encourage your managers to find ways to challenge and bolster the esteems of your valued workers.

UNREALISTIC CONTRACT TERMS

Don’t make promises you cannot keep or assume that others will provide services that are not explicitly laid down in writing. Taking time to craft a comprehensive contract that everyone understands and agrees to can protect both sides from years of bitterness and countless hours and profits lost.

(click to enlarge)

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.