Umbrella Policy Myths

As you go through the day-to-day, routine activities of running your business, the potential for a million-dollar lawsuit might seem negligible at best. Even if the worst should happen, you might be comforting yourself with the thought that your existing homeowners or auto insurance policies will be a perfectly adequate safety net. Consider yourself having just been given a wake-up call: Your current insurance is probably not enough. Chances are excellent that you need an umbrella policy that will truly be your security net when you have exhausted your other forms of coverage.

(info-graphic below article)

Does the idea of an umbrella policy confuse you or make you squeamish? If so, you might be operating under misconceptions that are depriving you of the coverage you need. Take some time to learn about these myths for the sake of your financial future.

Myth 1

Myth: If a claim is filed and paid out, the first policy used would be your umbrella insurance.

Fact: In reality, your umbrella policy is your secondary coverage. It does not kick in until your primary insurance has been exhausted. In fact, you cannot even obtain umbrella coverage unless you have a primary policy.

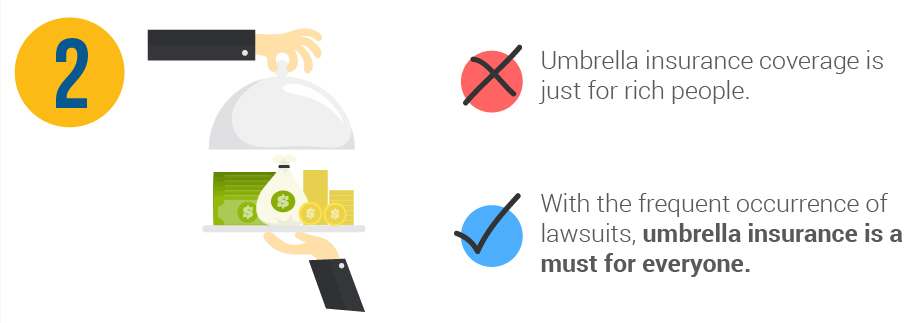

Myth 2

Myth: Umbrella coverage is just for rich people.

Fact: Quite the opposite is true. The fabulously wealthy may have more than enough resources to ride out the financial storm of a lawsuit whereas a struggling entrepreneur probably does not. Considering that just a few hundred dollars a year can usually buy you $1 million in umbrella coverage, it is well worth the cost no matter how tight your bottom line may be.

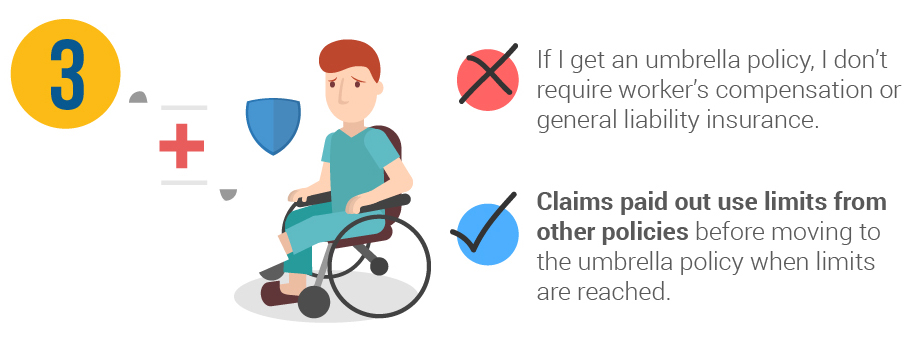

Myth 3

Myth: If I get an umbrella policy, I don’t require workers compensation or general liability insurance.

Fact: Because your umbrella policy will not go into effect until other coverage amounts have been reached, you absolutely must purchase these as well.

Myth 4

Myth: Umbrella insurance premiums are too expensive.

Fact: What you will pay depends on your own unique set of business circumstances. Of particular note is the amount of risk you run of being sued. For instance, someone who runs a tax preparation business will be at far lower risk than would a general contractor. Obviously, higher-risk businesses are charged more costly premiums. That being said, a lawsuit directed at a high-risk business is much more likely to be in the five or six figures.

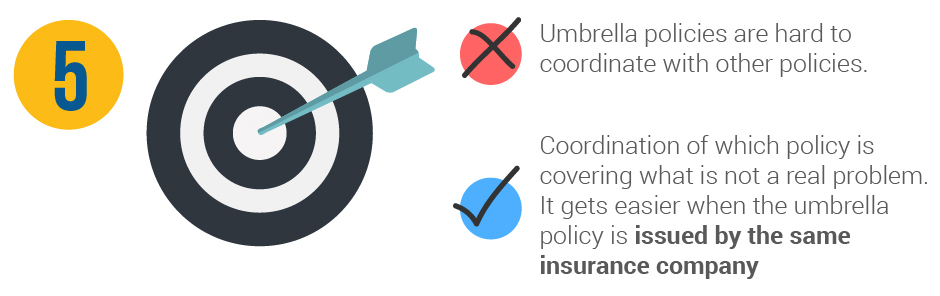

Myth 5

Myth: Umbrella policies are hard to coordinate with other policies.

Fact: If you have policies scattered across several insurers, there is a possibility of confusion. If you want to remove most of the guesswork from your coverage, take some time to look at a few different companies with a view toward consolidating all of your policies – homeowners, business and auto and umbrella.

How To Determine If You Need An Umbrella Policy

In one fell swoop, a lawsuit can take you from financial stability into the abyss of bankruptcy. Having at least $1 million in umbrella coverage above and beyond your other policies can be invaluable if you are forced to pay a legal judgment from your current assets and future earnings as well as the costs of your legal defense.

Here are some additional tips that will help you navigate your need for umbrella coverage:

- How likely is it that you will be sued by a customer or other individual or company? Think about variables such as any potential hazards on your property, the type of business you do, the reliability and potential for injury of your employees and the products you manufacture, if any. While no one is immune from litigation, some people are much more likely to encounter it than others.

- Sit down and make an inventory of your assets: your home, automobiles, boats, expensive appliances, computer equipment, business property, etc. Come to a ballpark figure of how much all of these things are worth in total.

- Take stock of your existing coverage. If you have not evaluated it recently, consider how your business has changed since the last time you did. Have you grown? Shrunk? Hired new employees or let some go? Are your assets more valuable? Has your neighborhood improved or declined? All of these factors need to be taken into consideration as you decide whether you have enough basic coverage.

- While virtually everyone can benefit from umbrella coverage, you definitely need it if the amount of your assets exceeds that of your coverage. Having it is also a must if you are at risk of being sued.

How To Save Money On An Umbrella Policy

As we have said above, umbrella policies are relatively inexpensive. This is because they are not activated until your primary coverage is exhausted. Even so, shelling out an extra few hundred dollars a year can be a daunting prospect for a new or struggling business. Fortunately, there are ways that you can save on your umbrella policy:

- Look at all of your current policies to see the amount of liability coverage you already have. It is very easy to sign on the dotted line without having a solid idea of the coverage you have purchased. Getting a grasp of these figures is your first step toward determining what else you might need.

- Contact your current insurer for an estimate. Your present carrier certainly does not want to lose your business and is highly motivated to help you obtain whatever additional services you need. As always, be honest with your agent about your needs and risks. It is far better to be forthcoming about even the most difficult issues now than to surprise your agent with them later when disaster strikes.

- Simultaneously gather estimates from competing companies. Rates change with time; what was the best deal a few years ago may have been upstaged by a rival in the intervening time.

- Once you have accumulated all of the information, analyze it carefully to arrive at the company that best suits your needs in all ways, not just economically. Remember, cheaper is not always better.

- If possible, consolidate all of your policies with one carrier. Doing so can often result in a better package deal and can eliminate a great deal of confusion and miscommunication.

- If you’re still scrambling for the money to afford umbrella coverage premiums, consider higher deductibles. Doing so will mean that you will be expected to pay more out of your pocket in the event of a claimable event, but in the meantime your monthly premiums can be lowered.

(click to enlarge)

Embed This Infographic

Copy and paste the code below to get this infographic onto your website or blog.